Let's find your trading edge today

OptionTerminal gives you powerful, easy-to-use quantitative tools to trade smarter - no coding necessary.

> Trusted by 150,000+ users

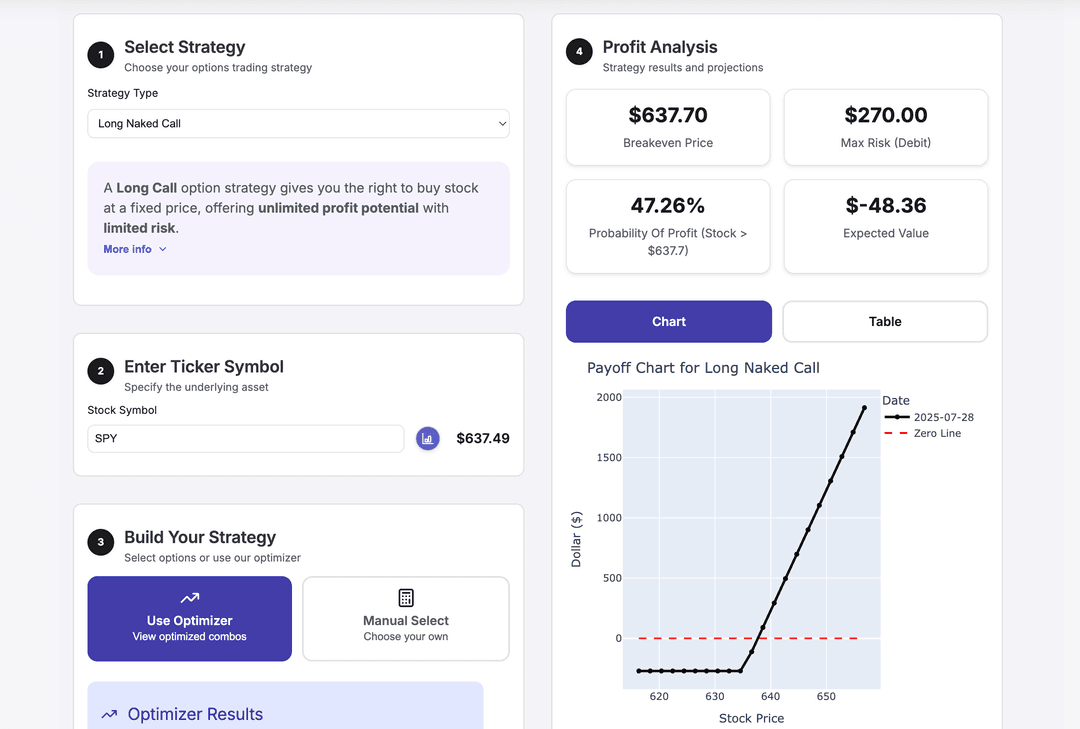

Visualize and understand trades at the

speed of thought

Bring us a stock and a strategy—we’ll turn it into clear outcomes and confident trades.

Try Calculator >

Strategy Screener Engine

Discover real-time setups across many stocks - high-reward, cheap premium, or max profit. Screener sorts thousands of trades instantly.

Try Screener >

Backtester + AI Insights

Test ideas across SPY, GOOG, VIX, or any name with real historical data — and let AI spot the edge. Validate your strategies before risking capital.

Coming Soon >Frequently Asked Questions

Everything you need to know about OptionTerminal and our trading tools.